Fields of Promise: Creating an Ecosystem for Agriculture Investment in Africa

Introducing Agbase at Sankalp Africa Summit 2024

The latest State of the Digital Agriculture Sector report from USAID and Beanstalk Africa highlighted that Africa is home to the most Agtech innovators in emerging markets, yet 50% remain unfunded. Africa attracts less than 2% of the global Agtech funding. This a major challenge for a sector in much need of a transformation and with increasing pressure on smallholder farmers and food systems more generally. Briter Intelligence estimates that over the next decade funding to Agtech needs to more than double from the $1.4bn raised over the last one.

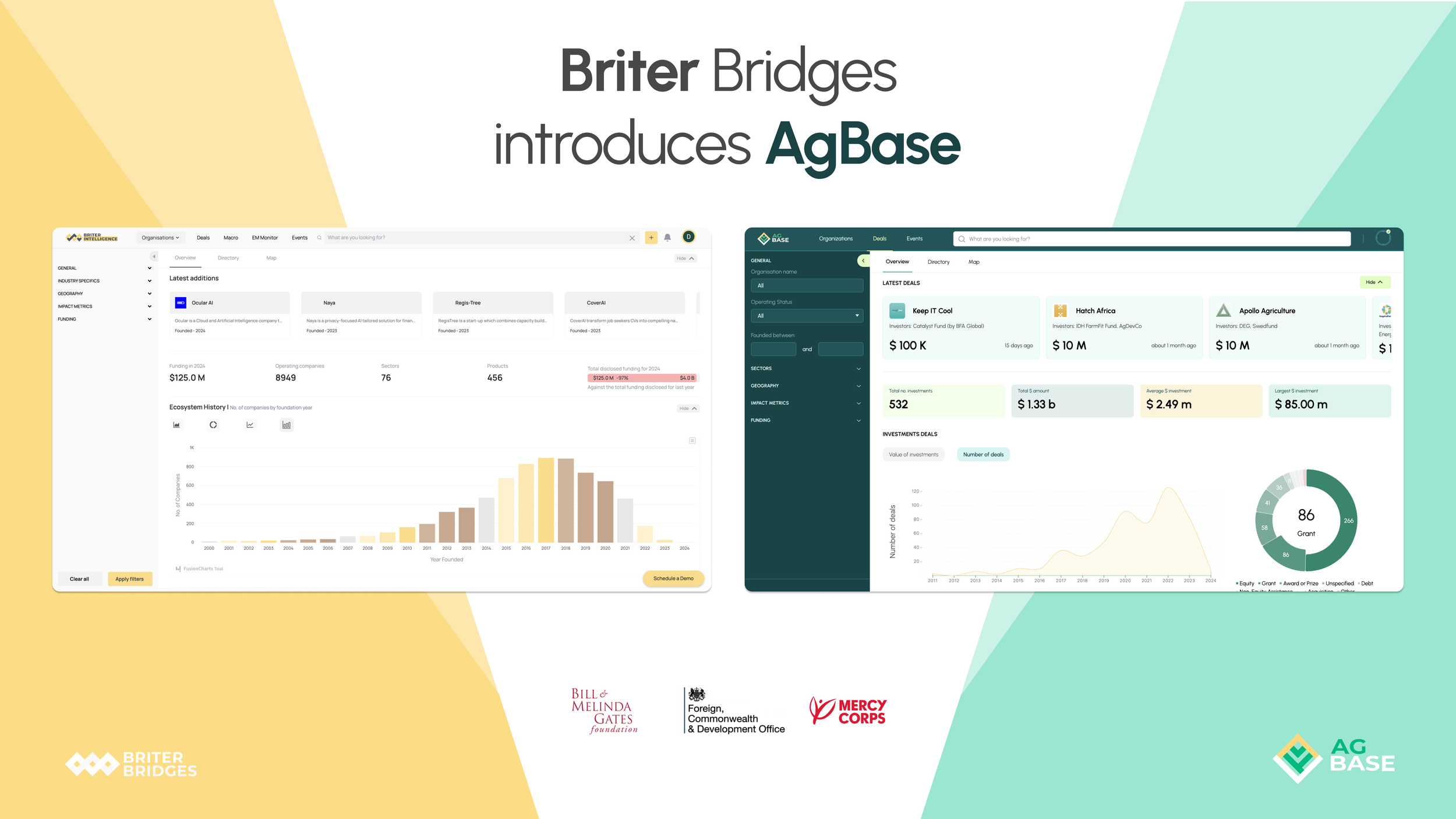

In response, Briter Bridges is collaborating with Mercy Corps Agrifin to improve the quality of data and intelligence available on Agtech ecosystems across Africa, and other emerging markets, to help increase investment in Agtechs in Africa. The initiative, Agbase, is funded by the Bill and Melinda Gates Foundation and the United Kingdom Foreign, Commonwealth and Development Office, and will work with implementing partners including Agfunder, ISF Advisors, CGIAR, the World Bank, 60 Decibals, amongst others.

In February, the first major milestone of the collaboration, the launch of the initiative and Agbase MVP, took place at the Sankalp Africa Summit in Nairobi, Kenya hosted by Intellecap. The launch take place during a panel discussion with Agfunder, ISF Advisors and FMO titled Fields of Promise: Creating an Ecosystem for Agriculture Investment in Africa and included two Agtech innovators operating in Kenya, Stable Foods and Capture Solutions.

Agfunder provided an overview of the global context around Agtech investing, Briter shared insights from it’s decade of Agtech ecosystem data, ISF provided a deep dive on Agtechs addressing climate adaptation and resilience for smallholder farmers and Stable Foods and Capture Solutions shared more about their journeys and they impact they’ve had to date. Below we present some of the key insights from the panel.

As part of the Agbase initiative, Briter has been conducting a deep-dive into it’s decade of Agtech ecosystem data with a specific focus on East Africa which were presented at the Sankalp Africa Summit in Nairobi. The deep-dive highlighted 5 trends:

Agtech is gaining traction in Africa, particularly in markets and products supporting farmers. Innovation ecosystems across the world have felt the impact of what looks like a reconfiguration of risk appetite for venture finance. Agtech is not excluded. Notably, unlike other emerging and developed markets, deal flow to agtechs in Africa has remained relatively stable and total funding is actually above pre-Covid levels. This may be driven by a few large deals, but significant activity at early-stage is real. Further, similar to other emerging markets (like India), the markets and products attracting the most funding target smallholder farmers. These include crop insurance, microlending and digital solutions for climate-smart agricultural practices and yield optimisation.

The majority of funding is going to agtech fintechs, agtech marketplaces and farm management services. What continues to be fascinating is how markets that have invested in wider digitalisation efforts, particularly extended digital services into rural areas, have created the rails which agtech companies can leverage to develop and disseminate solutions. For example, Kenya’s efforts to digitalise the wider economy have had big spillover effects for agtechs targeting smallholder farmers. Similar observations have been seen in India where initiatives like Aadhar and UPI have enabled the infrastructure for agtech fintechs, marketplaces and farm management services.

A range of public and private financing actors are driving agtech ecosystem growth, deploying a mix of grants, debt and equity. There have been more than 300 investors from across the globe that have made investments into agtech startups in Africa including VCs, DFIs, corporates, impact investors, angels, private equity funds. Further, the financing mix has gone beyond equity. More than 15% has been debt and a significant proportion of non-equity activity remains undisclosed. The biggest gap in funding? Late stage and acquisitions.

Support for agtech startups currently focused at the early stage, limiting growth and impact. One of the biggest gaps identified in supporting our ecosystem mapping is around funding and access to markets. The majority of support organisations focus at the early stage and provide technical support and small funding. There is a strong case for this, however startups identify this barrier.

Kenya is home to the biggest agtech ecosystem across the continent. Kenya has attracted nearly 60% of the total funding. The median deal size has been $1m, well above the Africa Agtech median of $380k. It has accounted for 22 of the 30+ deals above $10m.

Tech is disrupting markets in ways that can transform food systems. In addition to the trends shared above Agtech innovators, Stable Foods and Capture Solutions, shared their own observations around the Agtech sector in Kenya:

The opportunity for disruption remains high and biggest competition is not coming from other agtechs, but traditional methods of doing business like using cash and paper, and relying on rainfall for irrigation or importing food from abroad.

Digitalisation remains a key driver of agtechs. A major focus for Capture Solution is partnering with local cooperatives to foster digital solutions.

The majority of agtech products are hybrid software and hardware products. For example, Capture Solutions is a SaaS product, but deploys hardware in part of its efforts to digitalise the livelihoods of farmers beyond what SaaS products can provide.

An ecosystem approach to addressing the funding gap. While the above trends show an ecosystem on the rise, funding for Agtech’s still remains a major challenge. We were reminded of this at the Sankalp Africa Innovation Summit where many Agtech innovators approached us asking how they should approach funding, who they should approach and how they can best be featured on the Agbase platform. Funders also emphasised the need for more relevant data and intelligence that can help them market sense of the sector, identify co-funders and inform where their investments can be most impactful. These are only a few of the data and intelligence challenges that the Agbase initiative is looking to address. But it will take more than data and intelligence to address this gap. Agbase is looking to take an ecosystem approach collaborating with partners across the Agtech space in Africa and emerging markets to head the lessons from the last decade and shift the tide towards a more impactful and sustainable Agtech sector going forward.

If you are interested in learning more about the Agbase programme, how you can get involved and be part of the data and intelligence platform please sign up to our mailing list below: