B2B commerce landscape in Africa

Product Insights Series #4

The Product Insights Series is the next evolution of our flagship market mappings. It offers insights into the startups driving selected product markets across Africa’s technology ecosystems. The series builds on our #InnovationMaps with data from Briter Intelligence as well as interviews with startups to offer deeper information on each product or cluster. The fourth edition of the series examines some of Africa’s leading B2B commerce startups.

How B2B commerce companies are building to solve challenges for FMCG retailers post-Covid-19

The (changing) retail landscape in Africa

Africa's consumer spending is on the rise. The size of the market has reached $1.4 trillion and is projected to grow further in the coming decade. This spending has often not been visible in Africa as the retail landscape has traditionally been dominated by informal local shops, open market stalls and hawkers by the roadside. The majority of transactions are low value, cash-based and happen in person. Supplying these retailers with goods and services to meet their business needs is often complicated due to inadequate local infrastructure, lack of information, fluctuating demand, and import tariffs and restrictions. As a result, retailers have difficulty managing stock and accessing capital, which limits their ability to grow, and formal retail is constrained to a few shopping malls in urban areas in most countries. This is also true in larger economies across Africa like Kenya, Nigeria and South Africa, where informal retailing accounts for two-thirds of the total retail market.

Yet, this trend is beginning to change. The Covid-19 pandemic accelerated the adoption of digital technologies and many consumers started needing to engage with retailers remotely during the initial stages. Consumers that still wanted to physically go to retailers opted for big formal super markets where individuals could physically distance and safely shop. Informal retailers were left to adapt or be left behind.

This drastic shift in consumer behaviour and habits in retail created an opportunity for B2B commerce startups to not only respond to the retailers’ new challenges brought by Covid-19, but also to more broadly address persisting gaps in the commerce sector due to the predominance of physical interaction. In this #ProductInsights chapter, we take a look at B2B commerce startups, the solutions they offer, the challenges they are responding to and the financing gaps and opportunities for investors.

B2B commerce startups and their product offerings

B2B commerce startups target the exchange of information, products, or services between businesses. Through these B2B commerce startups, retailers are provided with the tools to offer improved customer service, expand their business, and have better access to financial services. Below are 4 ways in which B2B commerce startups are adding value to small businesses in Africa.

Making retailers visible

The majority of traditional stores in Africa do not keep a record of transactions (read here about startups digitising HR and payrolling processes across the continent) and many use paper books to store transactional data. This leaves them exposed to mistakes and gaps in their recording, but more importantly it prevents them from being within reach of most larger scale suppliers and financial service providers. Several B2B platforms are launching products to offer value-added services like transaction recording and tax services to retailers to enable them to better manage their accounting needs. Examples include Alerzo and Cartona. By digitising their transaction history, the retailers can become visible for the first time to service providers that can help them generate insights on their business, improve relations with suppliers and increase access to credit.

Providing trade intelligence for retailers

“Profiling and resource allocation is provided for merchants based on their transactions and importantly, their relationship to other merchants and service providers,” Ademola Adesina, Co-Founder and Director of Nigerian B2B commerce startup, Sabi.

Similarly to Sabi, many B2B commerce startups use their platform to obtain data around merchant services and their interactions with players in the value chain. This typically includes transaction records, method of receiving payments and the frequency of purchases from suppliers and customers. This data is used to generate customer, market, and business insights that help retailers track their business performance and pursue growth.

Creating win-wins for retailers and suppliers

“Retailers benefit from the ability to compare and order (provided by B2B commerce startups), and better manage their inventory in an industry that is characterised by slim margins and wholesalers are able to achieve higher demand generation and reach more and more retailers efficiently,” Mahmoud Talaat, CEO of Egyptian B2B Commerce Cartona.

The most common offering among B2B commerce startups consists of a digital suite for improved supply chain management between retailers and their suppliers. This helps to enhance inventory management and pricing. For example, Egyptian startup Cartona’s solution seeks affordability and flexibility in procuring goods for retailers by allowing minimum orders of significantly lower value from suppliers than the minimum required by wholesalers. The ability to deal with contained quantities is beneficial to many small retailers who cannot afford to make large orders. The benefit also goes both ways. As Mahmoud highlighted above, suppliers also gain from the relationship by reaching and selling to hitherto unreached-for retailers. While many B2B commerce startups do not provide distribution and logistics services other than connecting retailers and suppliers through their platform, some later-stage startups, leveraging larger funding and increased resources such as Wasoko do. As such, after investing in the more ‘traditional’ logistical arm, Wasoko is now able to provide free delivery services for retailers, in addition to offering digital solutions to manage their inventory, in order to guarantee a continuous supply of their goods.

Enabling access to credit products

“In a somewhat paradoxical scenario, retailers are the biggest credit providers (in Kenya) while they themselves are not necessarily able to access credit from their suppliers,” Fatma Nasujo, Global head of Operational Excellence for Kenyan B2B commerce startup Wasoko.

One of the most significant challenges in Africa for small businesses and retailers is cash flow.Access to working capital can often assist retailers with their cash flow problems, but historically that has been out of reach for most of them. This has begun to change as the better access to data B2B commerce startups have enable has allowed them to predict default and solvency rates and to start offering credit on top of their core commerce solutions. This is but another example of the breadth of use cases for embedded finance by non-financial service providers.

B2B commerce startups are proving to be a driver for in embedded finance use cases. As Mahmoud alleges, “embedded finance is a key pain point for retailers and we see a clear need for it in the industry.” Revenues from embedded finance grew by nearly 50% in Africa and the Middle East in 2022 reaching $10.3m. It is expected to reach nearly $40m by 2029. Spearheading the growth of embedded finance products are BNPL solutions that allow customers to pay for goods at a later time either in full or in instalments. For example, Cartona offers flexible payment options that are integrated into its checkout process allowing retailers to order goods seamlessly and to pay back digitally or through Cartona’s supplier network after a few days.

Other startups are also offering wholesale credit to retailers as a part of their embedded finance offering. Wasoko’s product enables retailers to continue offering credit to end consumers while also managing their own stock. As Fatma Nasujo explains, “what we do is we have a BNPL programme that allows retailers to sell fast and then pay later. So they take stock from us, sell to their customers and then they are able to pay us once they have their cash flows in order”.

As growth is experienced in the B2B commerce space and as competition intensifies, large players are striving to diversify their products to capture new markets and increase revenues. An example of this is Nigeria’s Sabi, which gone on to offer its suite of technology-enhanced services to merchants across several verticals including agriculture, chemicals, textiles, and electronics. Companies such as Capiter, an Egyptian B2B commerce startup connecting traditional retailers with suppliers and access to credit facilities, serves customers across food and beverage, fashion, and electronics.

The emerging innovation and investment ecosystem for B2B commerce startups

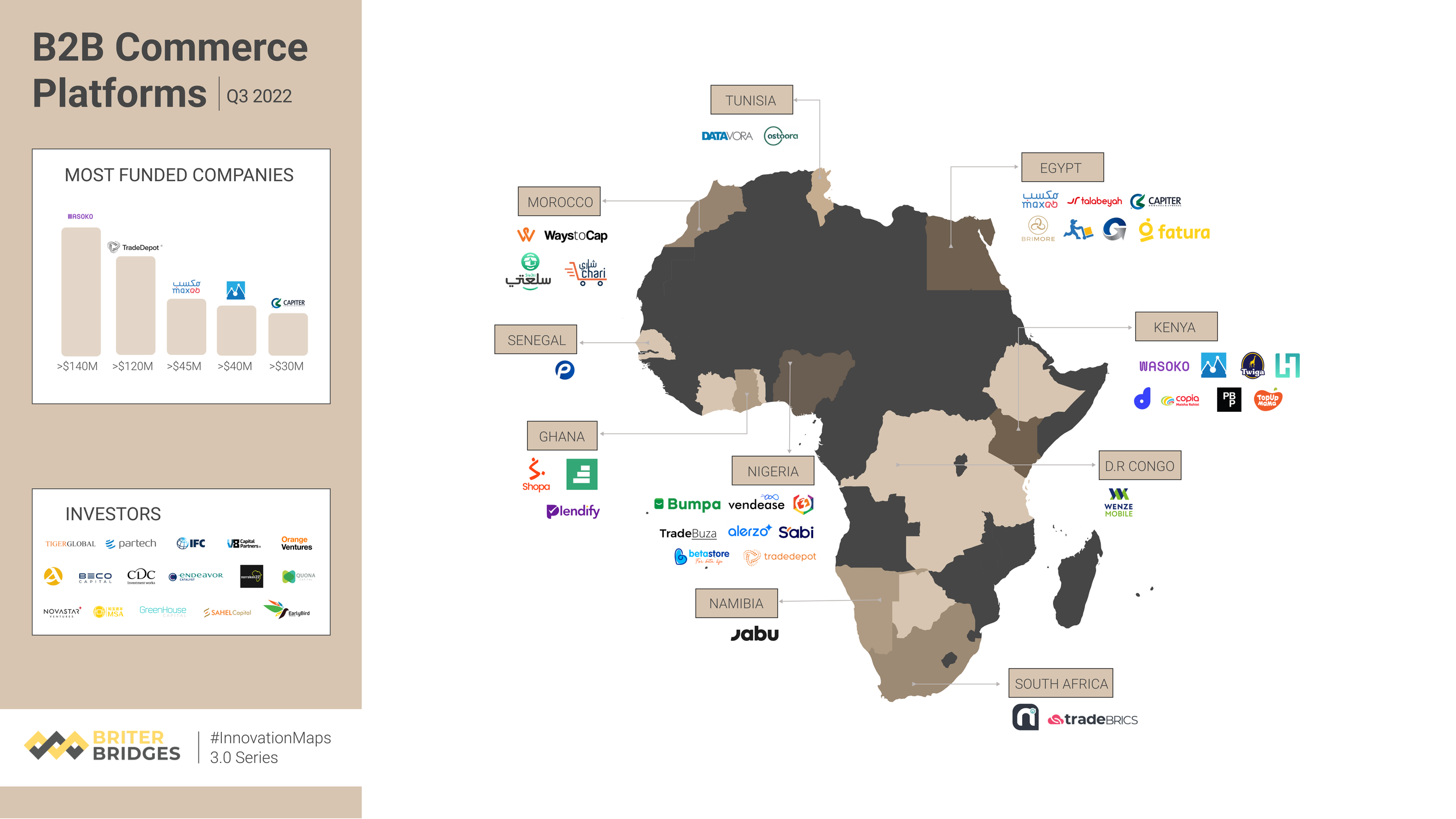

Data from Briter show that 28 African startups offering B2B commerce as a product have collectively raised over $470 million in funding since 2008, with 90% of this amount raised between 2021 and 2022 alone. The funding is shared among seven geographies from the most to the least funded: Kenya, Nigeria, Egypt, Morocco, Senegal, South Africa and Ghana. Several investors are driving investment into this space, including Tiger Global Management, 4DX Ventures, Y Combinator, Disruptech, and the International Finance Corporation (IFC). Leading B2B commerce startups building for Africa’s retailers include:

Alerzo, a Nigerian B2B trade platform empowering informal retailers in emerging markets with digital solutions to transform how they operate;

Cartona, an Egyptian B2B e-commerce marketplace streamlining the distribution process for buyers and sellers by directly connecting retailers with wholesalers, suppliers and FMCGs.

TradeDepot, a Nigerian mobile B2B trade and distribution platform facilitating the connection between retailers and consumer goods producers in Africa;

Jabu, a Namibian last-mile distributor reinventing the way small retailers in Southern Africa order, stock and receive supplies;

Twiga, a Kenyan B2B distribution platform streamlining supply chain processes for manufacturers and suppliers and increasing their reach to Africa’s vendors and consumers;

Capiter, an Egyptian B2B marketplace connecting traditional retailers with suppliers and access to credit facilities;

Marketforce, a Kenyan B2B retail startup providing a unified digital commerce marketplace to facilitate trade among Africa’s informal merchants and leading consumer brands;

Chari, a Moroccan B2B e-commerce platform helping retailers in French-speaking Africa have access to consumer products and financial services;

Omnibiz, a Nigerian B2B e-commerce platform digitising traditional trade in Africa by streamlining the supply chain process for suppliers and retailers;

Wasoko, a Kenyan B2B e-commerce platform transforming retail in Africa by fixing inefficient supply chains; and

Sabi, a Nigerian B2B retail platform providing technology enhanced services that help merchants in the informal economy grow.

The B2B market is also attracting big players from other sectors eyeing opportunities in Africa and the Middle East’s social commerce industry. It is estimated to have grown its revenue by 70% in 2022 reaching $8.9 billion and is forecasted to reach $13.3 billion by 2028. Since 2020, four of Nigeria’s leading fintech platforms have launched e-commerce products to enable online merchants to sell easily to their customers including Paystack’s Commerce, Flutterwave’s Store, Remita’s Paylink and Quickteller’s Storefront. They join social commerce platforms like Egyptian-based Brimore and Taager that have each raised a considerable amount of venture capital funding to deliver tools to online merchants. Social media platforms like Whatsapp, Facebook, Twitter, TikTok, and Instagram are also playing a role, but are mostly used by existing online sellers to sell their products to consumers in their social network. Africa’s innovative B2B commerce startups are differentiating themselves through localised payment and delivery solutions to their customers, which are not offered by global social platforms.

The pursuit of growth by startups in the B2B commerce space is also being demonstrated through consolidation and the increase in mergers and acquisitions (M&A) activity between larger players and smaller companies that offer access to additional services or new geographies. An example is Chari, that has acquired three companies in the past year including Axa Credit, Karny, and Diago, that offer credit, bookkeeping, and inventory management solutions respectively. Chari’s acquisition of Ivorian startup Diago also provided an inroad for the Moroccan B2B commerce platform to expand into West Africa. With many digital solutions being launched to digitise trade in Africa, one can say it’s the retailer’s market.