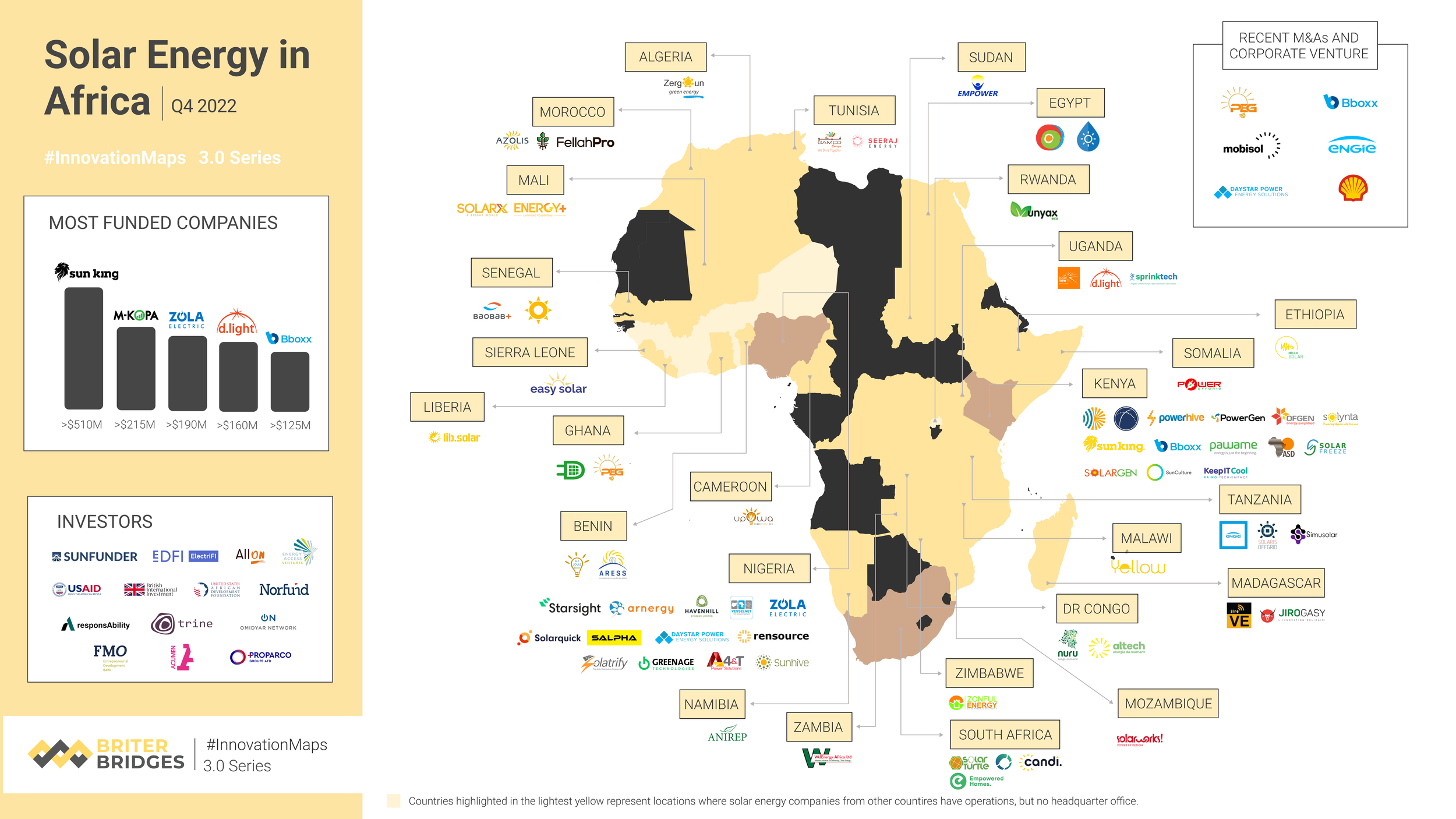

The solar energy startup landscape in Africa

This article is part of a 2-piece mini-series within our #ProductInsights Series looking at the state of solar energy in Africa. This article focuses on solar energy startups, while the following one aims at shedding light on the broader landscape dominated by large government, global, and multilateral institutions-driven solar farms and infrastructure. Solar energy initiatives are abundantly present across Africa and this map intends to provide a snapshot of existing entrepreneurs. There exist several projects financed and run by NGOs all across the continent that are not included in this map.

Many African economies experience poor electricity supply and are characterised by frequent blackouts and brownouts. Only 58% of Africa’s population has access to electricity as a result of low production and infrastructure across the continent. As a result, diesel- and petrol-powered generators have become substitutes used by businesses and in homes to provide energy during periods of power outages. However, in recent months, the demand for alternative power sources has continued to increase due to rising diesel costs, and this risks turning into a great humanitarian problem in that the majority of informal dwellers, who are already excluded from basic services, see their precarious energy supply significantly reduced. Factors contributing to the diesel price hike include geopolitical issues such as the Russia-Ukraine war. Africa has historically relied on hydropower as its largest renewable energy source for electricity generation. However, with reduced costs for photovoltaic solar panels, an increasing number of Africans are turning to solar energy as an affordable and reliable way to supply power to their homes and offices.

Solar energy is often preferred among renewable energy sources, such as wind and micro-hydro, because of its relatively lower setup costs, low maintenance needs, the ability to instal panels on several types of surfaces and terrains, and reliable and predictable output. Solar energy is also used in agriculture, trade, and commerce to enable mechanisation. Among the main beneficiaries of solar energy applications are smallholder farmers living in rural areas in parts of Africa that are not connected to the electricity grid. As an example, solar water pumps enable farmers to continue planting even in seasons affected by drought and irregular rainfall. This helps them to support their families and improve their livelihoods. Despite its potential, the uptake of solar energy remains in its early adoption stage in most parts of Africa, and one reason for this are the significant upfront costs users face when it comes to having solar systems installed and connected. Currently, solar energy generates 9,604 MW of electricity in Africa while 7,158 MW is under construction to increase the continent’s installed solar capacity.

Innovative companies across the continent are supporting the distribution and adoption of solar energy by offering solutions to democratise access to affordable and reliable electricity to households and businesses. In the final article in this #ProductInsights series sub-division of agriculture and climate tech, our spotlight is on solar energy startups as we examine some of the key products they offer, the target market being addressed and the financing gaps and investment opportunities to scale the industry.

Solar energy startups and their product offerings

Solar energy startups increase access to electricity to underserved people in rural and urban areas across Africa, empowering households and businesses whose livelihood and daily life and work depend on a reliable power supply. The solutions that fall under the umbrella of solar energy address electricity problems, climate change, food insecurity, and financial exclusion in the following ways:

Democratising access to quality energy products for consumers

Solar home systems (SHS) are increasingly replacing the use of harmful kerosene lanterns in parts of Africa without access to grid connection. SHS allow users to have lighting, charge their phones, and power their electrical appliances. One of the most funded providers of SHS in Africa is the Kenyan solar company Sun King (formerly Greenlight Planet). To enable its customers to afford its off-grid solar solutions, Sun King allows payments in instalments of as little as $0.22 per day after an initial deposit. Payback periods for the SHS typically take up to 12 months and collection is made via mobile money systems such as MPESA. This model, referred to as pay-as-you-go (PAYGo), allows users to pay per unit of electricity used. It also provides a means of owning solar assets which include mobile solar lanterns and cookstoves. Several solar companies have adopted PayGo to deliver fast and reliable access to clean energy products for low-income households in Africa. Some of them include M-KOPA, d.light, and Easy Solar.

Providing access to solar systems for commercial users

In addition to providing solar home systems for individuals and households, a number of solar companies offer solar solutions to commercial users. This reduces their dependence on diesel generators and the grid to power their operations resulting in cost savings. Senegalese-based solar company Oolu is a leading example of installing and maintaining solar systems for commercial and industrial clients across West Africa. An example of a commercial application of off-grid solar systems for businesses is powering telecommunication base stations to provide network coverage in remote areas with unreliable power supply.

Improving financial inclusion for underserved Africans

Some startups have expanded the piloting of the PayGo model to provide financing for entertainment and refrigeration products such as smartphones, TV, and fridges. This enables people without a bank account or a credit history to have access to financial services to enhance their quality of life. M-KOPA is an example of a solar company that offers credit products, including cash loans, to financially underserved Africans.

Reducing operational costs for farmers

“We see the use of solar and renewable energy important for climate mitigation while being able to supply smallholder farmers with a clean and affordable way to irrigate their farms as climate adaptation," Mikayla Czajkowski, Chief of Staff at SunCulture.

Off-grid solar energy is being used in Africa to power agricultural appliances such as water pumps, coolers, and processing machines to provide irrigation, refrigeration, and agro-processing respectively. Commonly referred to as productive use leveraging solar energy (PULSE) appliances, they provide opportunities for smallholder farmers to improve their efficiency and increase their income. Solar startups in Africa, like Kenya-based SunCulture, are piloting and scaling PULSE solutions for farmers to mitigate and adapt to the effects of climate change.

Farmers in Africa are predominantly affected by post-harvest losses, as they lack cooling and refrigeration equipment to maintain the quality and efficacy of their produce. The provision of hybrid solar solutions by digital actors in Africa such as InspiraFarms ensures that farmers have access to continuous refrigeration at a reduced cost. This is made possible by integrating solar power into the existing power setup of farms.

“The integration of hybrid (grid-solar-diesel) solar systems ensures a significant reduction in operational costs of post-harvest management for farmers,” Grace Maina, Marketing and Communications Officer at InspiraFarms.

The emerging innovation and investment ecosystem for solar energy startups

Briter’s tracking of funding flows into African startups reveals that 70 startups offering solar energy, solar home kits, and solar irrigation systems have collectively raised over $1.9b in disclosed funding since 2012. An additional 100 startups in the solar energy ecosystem have raised funding without disclosing the deal value. Of this amount, growth stage and bridge rounds account for 39% of disclosed funding. Top recipient geographies for funding include Nigeria, Kenya, Uganda, and Zambia. Top funders include development finance institutions (DFI) and debt financing venture capital firms such as SunFunder, EDFI ElectriFi, All On, Energy Access Ventures (EAV), USAID, and CDC Group. Financing for solar projects in Africa has mainly been provided by DFIs and philanthropic organisations targeting social and environmental impact creation. However, with Africa’s growing investment landscape, venture capital and private equity firms are targeting outsized returns by helping highly fast-growing companies pilot and scale innovative models across the continent. Growth-stage solar companies in Africa include:

Sun King (formerly Greenlight Planet), an energy company designing, distributing and financing solar home energy solutions to households and businesses;

M-KOPA, a Kenyan platform offering asset financing solutions to underbanked customers, providing them access to life-enhancing products and services;

Zola Electric (formerly Off Grid Electric), a Nigeria-based startup democratising access to energy with solar and smart storage power solutions that deliver reliable power, anywhere;

d.light, a Kenyan startup providing distributed solar energy solutions for households and small businesses, transforming the way people all over the world use and pay for energy;

Bboxx, a Kenyan solar company designing, manufacturing, and distributing plug-and-play solar systems to enhance access to energy throughout Africa;

Lumos, a Nigerian solar startup offering access to clean, affordable, and reliable electricity to individuals and small businesses in emerging markets;

Daystar Power, a Nigerian solar company providing businesses in Africa with clean, continuous power and focusing on hybrid solar power solutions for commercial customers for either a cash sale or a monthly fee;

PEG Africa, a Ghana-based an asset financing company selling PAYGo solar energy products, enabling customers to replace their perpetual spending on poor-quality polluting fuels such as kerosene with solar energy;

Rensource Energy, a leading Nigeria-based provider of off-grid energy, powering the productivity of small and medium-size enterprises;

SunCulture, a Kenyan company offering solar-powered solutions that provide smallholder farmers with reliable access to water, irrigation, lighting, and mobile charging;

Oolu, a Senegalese solar power company offering access to high-quality PAYG solar home systems and financial services to off-grid villages in rural West Africa;

Easy Solar, a Sierra Leonean last-mile distribution company providing access to solar energy products for people in rural West Africa.

Solar companies looking to scale in Africa are doing so by expanding into new geographies, competing on pricing while providing reliable energy sources,, introducing financial services to their core products, and developing use cases for their customer base in rural, peri-urban, and urban areas. A number of companies are exploring new revenue streams such as offering carbon credits to global companies seeking to offset their carbon footprint.

Developing solar products in underdeveloped markets can be risky as they are associated with significant hardware investments. User willingness is another challenge, as innovators need to convince users to trust the solutions and ensure that the customers are able to make regular payments. Solar companies that have successfully piloted are scaling operations and locations to increase the uptake of solar products. Some methods that have been used to build consumer trust include offering training to farmers, using agents to provide efficient distribution networks, and providing free after-sale services, product upgrades, and warranties.

A growing market for exits and acquisitions

Solar companies reaching maturity are also beginning to attract the attention of global oil and gas companies of the like of Shell and Engie, as well as manufacturing corporates such as Japanese Mitsubishi, Mitsui, and Marubeni, which are looking to transition into renewable energy. For instance, Nigeria-based Daystar Power was among the three renewable energy companies acquired by global oil giant Shell in the past year following the acquisition of India-based Sprng Energy, and US-based Savion. As the world commits to reaching net-zero emissions by 2050, Africa can play a major role due to the abundance of renewable energy resources on the continent, but, to achieve this, Africa will benefit from more open channels of communication among investors and donors of different nature, as well as de-risking capital from global institutional investors to develop critical infrastructure.